The Definitive Guide for Clark Wealth Partners

Clark Wealth Partners for Dummies

Table of ContentsThe 6-Minute Rule for Clark Wealth PartnersFascination About Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.More About Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.What Does Clark Wealth Partners Mean?The 20-Second Trick For Clark Wealth Partners

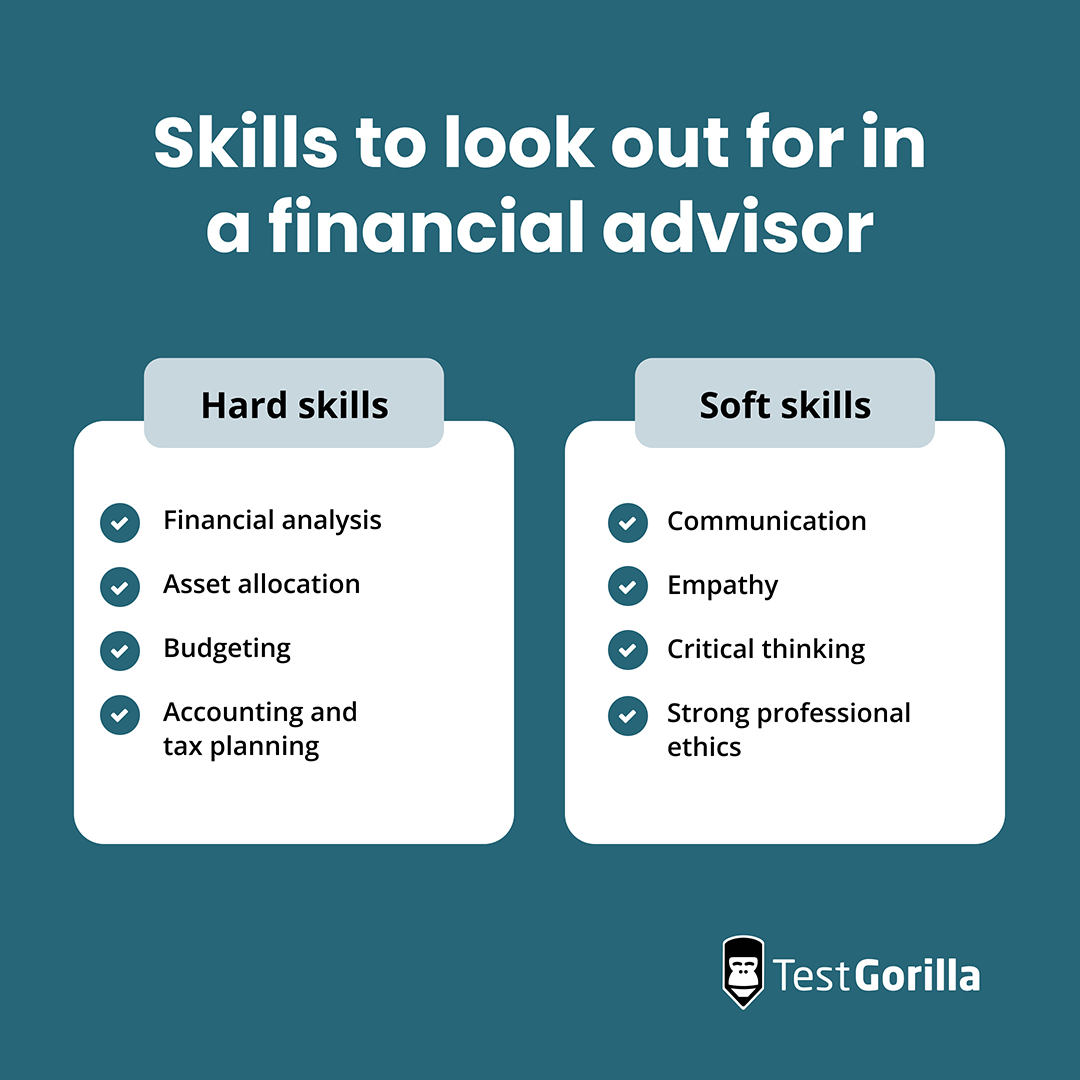

These are professionals who provide financial investment suggestions and are signed up with the SEC or their state's safeties regulatory authority. Financial advisors can also specialize, such as in trainee lendings, senior needs, taxes, insurance and other facets of your funds.Only economic consultants whose designation requires a fiduciary dutylike licensed financial organizers, for instancecan state the same. This difference likewise implies that fiduciary and economic consultant cost frameworks vary as well.

9 Easy Facts About Clark Wealth Partners Described

If they are fee-only, they're much more likely to be a fiduciary. Numerous qualifications and designations call for a fiduciary task.

Selecting a fiduciary will ensure you aren't guided towards certain financial investments because of the payment they offer - financial planner scott afb il. With lots of cash on the line, you may want an economic specialist who is legally bound to use those funds very carefully and only in your finest rate of interests. Non-fiduciaries might recommend investment products that are best for their wallets and not your investing goals

Top Guidelines Of Clark Wealth Partners

Boost in savings the ordinary family saw that worked with an economic advisor for 15 years or even more compared to a similar house without an economic consultant. "More on the Worth of Financial Advisors," CIRANO Task Reports 2020rp-04, CIRANO.

Financial recommendations can be useful at turning factors in your life. When you meet with an advisor for the first time, work out what you want to get from the guidance.

7 Easy Facts About Clark Wealth Partners Explained

As soon as you've agreed to go in advance, your monetary adviser will certainly prepare a financial strategy for you. You must always really feel comfortable with your adviser and their guidance.

Insist that you are alerted of all deals, and that you receive all communication associated to the account. Your adviser may recommend a handled discretionary account (MDA) as a way of handling your investments. This entails signing a contract (MDA contract) so they can get or offer investments without needing to get in touch with you.

More About Clark Wealth Partners

To shield your money: Don't offer your adviser power of lawyer. Insist all communication concerning your investments are sent to you, not simply your advisor.

This may take place during the conference or online. When you get in or restore the recurring fee plan with your advisor, they ought to explain exactly how to finish your relationship with them. If you're relocating to a brand-new consultant, you'll need to organize to transfer your monetary documents to them. If you require help, ask your adviser to explain the process.

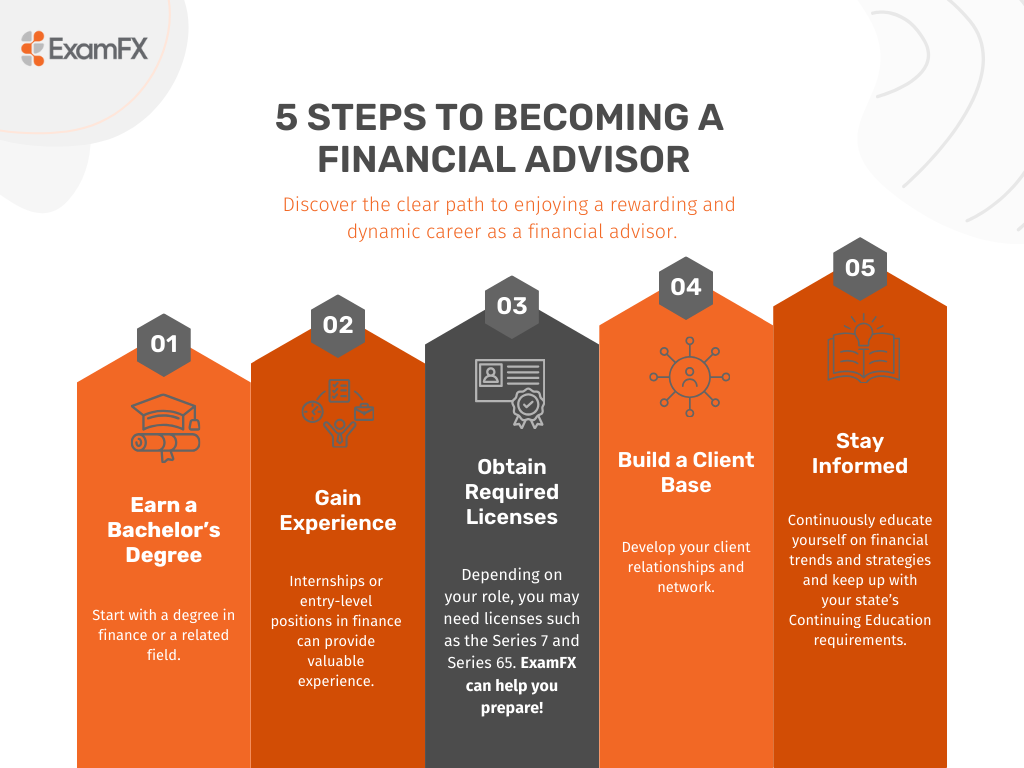

will certainly retire over the following years. To load their shoes, the country will need greater than 100,000 brand-new monetary experts to enter the industry. In their everyday work, financial experts manage both technological and imaginative jobs. U.S. News and World Report ranked the duty amongst the top 20 Finest Company Jobs.

Some Known Questions About Clark Wealth Partners.

Helping people accomplish their monetary objectives is a financial consultant's main feature. They are also a little business owner, and a portion of their time is dedicated to handling their branch workplace. As the leader of their technique, Edward Jones financial consultants require the leadership skills her explanation to employ and manage team, along with the organization acumen to develop and implement a business technique.

Financial experts invest time each day enjoying or reviewing market news on tv, online, or in profession publications. Financial advisors with Edward Jones have the benefit of home office study groups that assist them keep up to date on supply referrals, common fund monitoring, and a lot more. Spending is not a "set it and forget it" activity.

Financial experts must arrange time each week to meet brand-new individuals and catch up with the people in their ball. Edward Jones financial experts are fortunate the home workplace does the hefty lifting for them.

The 15-Second Trick For Clark Wealth Partners

Continuing education and learning is a required part of keeping a monetary advisor certificate (st louis wealth management firms). Edward Jones financial experts are encouraged to go after extra training to broaden their expertise and skills. Commitment to education and learning protected Edward Jones the No. 17 place on the 2024 Training APEX Awards checklist by Training publication. It's likewise a good concept for financial experts to go to sector conferences.